14 Oct

Understanding How Events Affect Demand and Pricing for the Car Rental Business

Historically, car rental pricing has depended on how large an event was: the larger the event, the higher the price and revenue managers knew all the large events well and that made sense.

However, in recent years, less popular events have grown in appeal, and more destinations base their marketing on micro-events.

The travel and events landscape is much different today with many new micro-events like music festivals, shopping festivals etc. appealing to millennials travelers

With the increase in the number of trips, travelers and events, how do different types of events influence car rental rates? How do pricing analysts measure the impact of events in a data-driven way that allows them to maximize revenue?

The answers to these questions lie in what RateGain calls “digital composite data” which includes, events, search, airline fleet capacity, booking pick up, historical booking data, weather, competitive intelligence, competition promotion patterns, etc.

There is power in digital composite data. It helps us understand consumer behavior more intimately and draw conclusions for taking larger decisions that directly impact our business.

Travel is now being driven more by impulse than ever before and digital composite data allows us to prepare for those impulsive decisions by monitoring search data, market trends and compare fares to see what people are interested in

Pricing analysts that want to optimize car rental rates should develop a nuanced approach to event-based pricing. To highlight how pricing analysts can use digital composite data for demand-based pricing, consider a recent RateGain analysis on the connection between car rental rates and local events.

5 ways that events influence car rental pricing

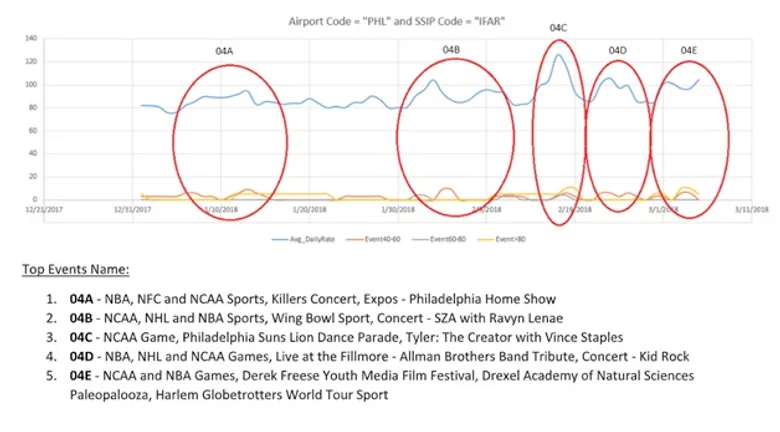

To explore the correlation between price and event quantity/quality, we grouped events according to perceived reputation and impact in six views across four key markets.

We plotted them on a timeline to show how event clusters drive nearly as much rate compression as isolated marquee events.

The full methodology is at the end of this article. This analysis revealed five key insights into leveraging digital composite event data for better pricing decisions.

Takeaway #1: Clusters of less popular events increase prices

Philadelphia is the best case study for how clusters of less popular events can nudge prices higher.

Nearly all of the price spikes were during periods when there was no major popular events with event popularity in the range of 80-100, in a scale of 0 to 100.

Notice how the biggest cluster of events, marked as 04C, produced the most notable increase in average daily rate. Pricing analysts should be sensitive to event clusters.

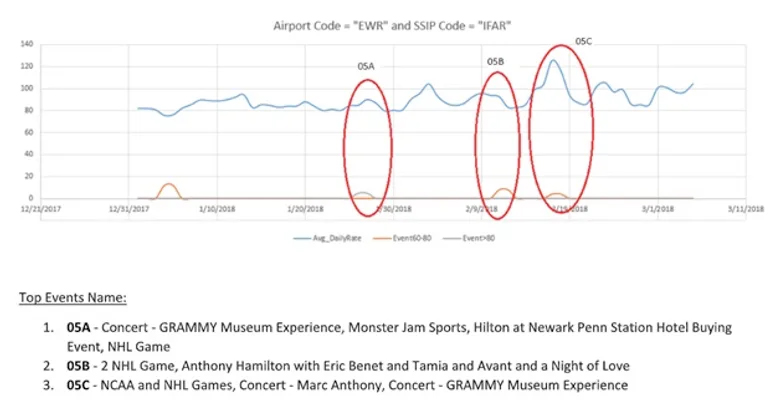

Takeaway #2: Be aware of anomalies

Newark is at the other end of the spectrum from Philadelphia, offering a contrarian view.

Spikes don’t always correlate to events — and the steepest spike during this period didn’t correlate to the largest no. of events.

Pricing analysts must track trends in each market to understand market specific behavior and trend.

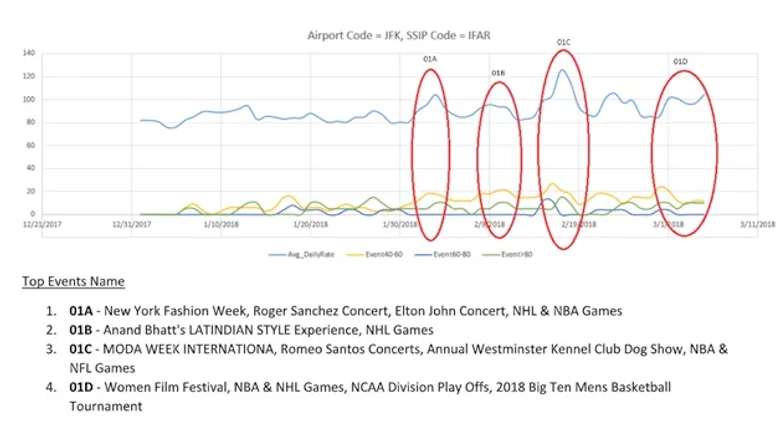

Takeaway #3: Zoom out to learn more

New York is the reason for Newark’s anomaly. If we take a regional view to the same dates used in the analysis for Newark, we see a spike in event velocity around 2/19.

This demand came to Newark from New York, increasing prices across the region; this is an important reminder to account for both local and regional market demand when pricing car rentals.

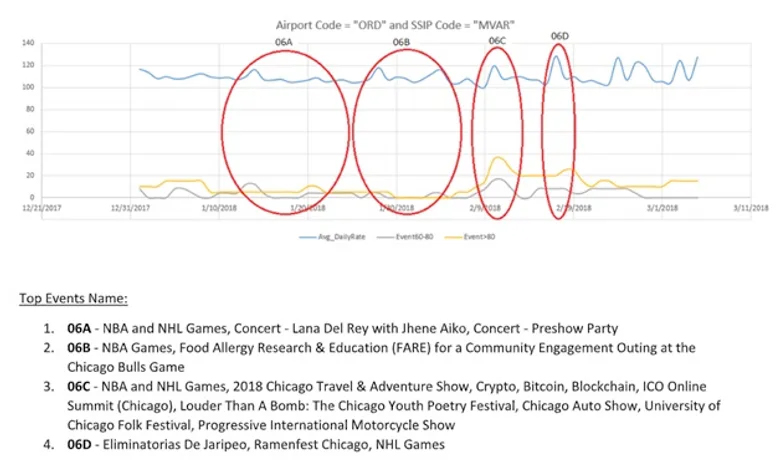

Takeaway #4: Sustained quantity of events boosts prices

Chicago was nearly perfectly correlated. Towards the end of the period, the sustained cadence of mid-tier events managed to trigger another jump in average rate.

Pricing analysts should look at how long a series of events lasts; if there is a period with a sustained increase in events, pricing should go up.

Takeaway #5: Event demographics change demand for specific vehicles

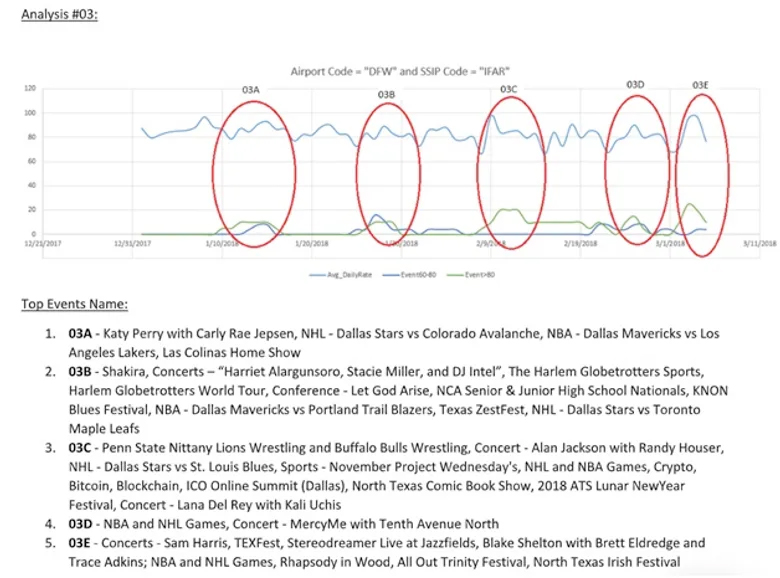

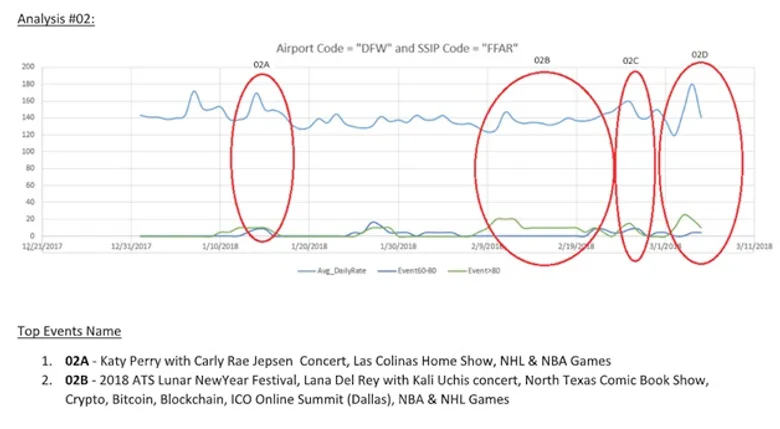

For Dallas, the average daily rate for two different vehicle categories, IFAR (mid-size SUV) and FFAR (full-size SUV) was mapped.

In the resulting graphs, we can see how event demographics affect demand for specific categories.

When measured from the baseline rate, the larger marquee events triggered a bigger jump in daily rate for full-size SUVs than mid-size SUVs.

We attribute this to more groups traveling further distances for these events, thus requiring bigger sized cars.

Settling the debate: Number of events or number of audience… what works better?

Most car rental companies think that the popularity of an event matters most.

Events with national and international reputations attract more visitors and thus leads to increased demand, which in turn drive up prices for car rentals.

Moreover, with this research, we wanted to test the hypothesis.

What we didn’t expect to find was that the velocity of events also matters. When there is a cluster of events around the same time, prices go up even if these are less popular events which are unlikely to garner much car rental demand on their own.

As we saw in our analysis, event clusters had nearly as much impact on the car rental rate as the more popular events.

So while it’s important to factor in major events, car rental revenue management analysts should also consider smaller events — especially when they are scheduled to happen during the same period.

To use data to your advantage, leverage your competitive price intelligence or rate-shopping products to cluster similar events, track local demand trends, make accurate forecasts and adjust pricing accordingly.

Don’t ignore vital pieces like the no. of events, clusters of events and reputation of events.

It’s important to also monitor search data to see any real-time shifts in demand.

Events data combined with other digital composite data can help in better demand forecasting leading to better capacity planning, better pricing and promotion

Armed with this information, car rental pricing analysts can make the best decisions that maximize car rental revenues.

Methodology

All analysis in the article is the property of RateGain’s data science lab derived by using proprietary algorithms, RateGain’s own data, as well as third party data to leverage social, news, events and weather data.

The event data along with event ranks were provided by PredictHQ.

We categorized events based on event’s popularity on a scale of 100 according to venue size, venue location, historical travel demand through solutions like CarSight, and social media buzz. The larger the number, the more significant the event.

- We then segmented into four buckets according to estimated impact, where higher numbers correspond to greater impact.

- For each date, we multiplied the number of events in each bucket with their estimated impacts.

So if there were 5 events ranked between 80 and 100, we multiplied each event’s score by the total number of events in the 80-100 bucket.

* CLARIFICATION – changes were made to the Methodology section of this article to reflect the use of PredictHQ’s services during RateGain’s analysis.